Michael Wildeveld, a high school valedictorian, holds a B.A. in Economics from Vanderbilt University and an MBA from the University of Michigan’s Ross School of Business. Michael is active in leading Merger & Acquisition, Exit Planning and Business Valuation industry organizations, is a M&A Master Intermediary (M&AMI), an expert witness, and a member of the National Association of Certified Business Valuators and Analysts (NACVA), the Association for Corporate Growth (ACG) and ProVisors. He holds the following certifications – Mergers and Acquisitions Professional (CM&AP), M&A Advisor (CM&AA), Business Intermediary (CBI), Business Broker (CBB) and Exit Planning Advisor (CEPA).

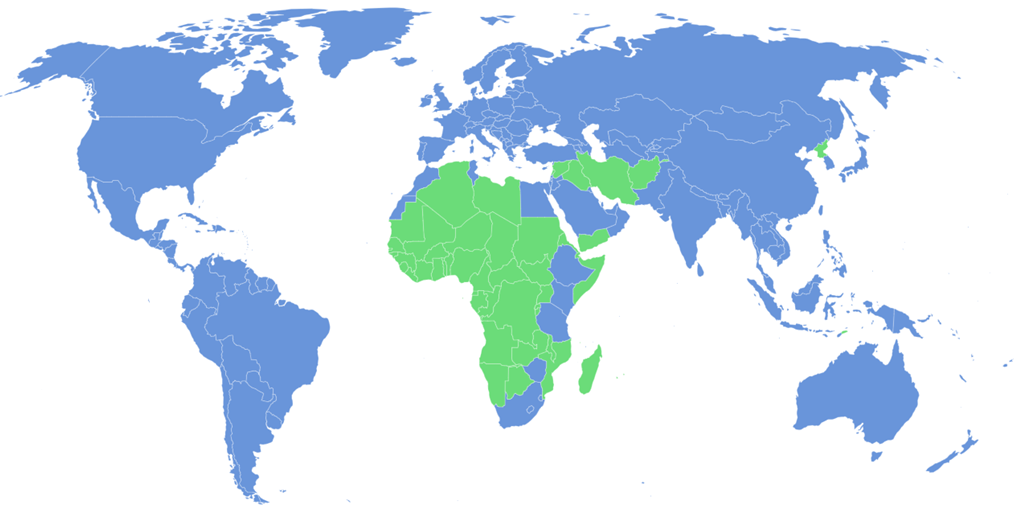

Michael started Value-Line Maintenance at 18 and turned it into a 35-employee enterprise within a year. Following college, he gained blue chip experience with best-in-class employers. He worked in finance for American Airlines, internal audit for ARCO/BP, business development for Virgin Entertainment, and strategic planning and buy-side mergers and acquisitions for both G.E. Capital Aviation and Universal Pictures. Mr. Wildeveld consulted for Jordan’s Queen Noor, government of Jordan and El Salvador, Fred Alger Investment Management and The Landmine Survivors’ Network, a NGO winning non-profit. Michael has carried out projects in 19 countries in Africa, Asia, Europe and South America.

Mr. Wildeveld launched The Veld Business Advisory Group in 2002 with his best friends since age 14. Though it began as a consulting and valuation firm, he launched their business brokerage in 2004 and later their boutique mergers and acquisitions practice to address the substantial challenges that clients with less than $20 ml in enterprise value faced when going to market. Since then, the companies have performed over 300 formal and 5,000 informal business valuations, orchestrated over 1,000 sell-side transactions and achieved an 80%+ success rate versus the 30% industry standard.

Michael is passionate about cultivating disruptive concepts and regularly engages in innovative, business service and product launches, acquisitions and roll-ups where value may be created or valuation multiples arbitraged. He has accomplished this in the food manufacturing, printing, health and beauty services, hospitality and financial services industries.

Michael has made television appearances on NBC’s Business Spotlight, CBS’s Great Day Live, Warner Media’s CW Network, Bloomberg TV, and Kevin Harrington’s (one of Shark Tank’s original sharks) show “Get Down to Business” that showcases entrepreneurs and business innovators. Michael makes regular appearances on podcasts and radio shows such as Entrepreneur.com and Remarkable Radio’s “Business Innovators Spotlight.” Michael has been quoted in Forbes and the Los Angeles Business Journal and was featured on the cover of Financial Services Review. He has spoken to a variety of audiences at events, is a contributing author to “Business Selling Insights Vol. 2” and “Exit Smart,” and has authored “Exit On Your Terms – Expert Hacks to Get More, Keep More, and Beat Private Equity at their own Game” which is due out in 2023. Michael has completed a marathon yet remains a struggling golfer. On his quest to explore the world he has visited all 7 continents and 150 countries and counting.